We probably all want to be better with our money than we actually are, but it’s often easier said than done. Sometimes we are completely clueless on how to even save. We make budgets, but then it’s hard to follow them or keep track of our spending. Well, these free apps will make your life a whole lot easier!

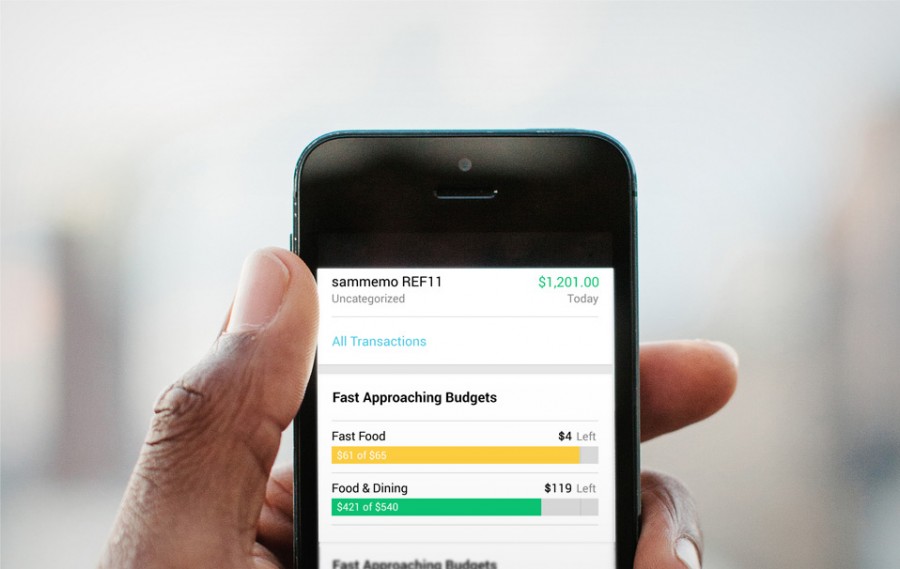

1. Mint

Visit the website here | Download available for Apple users & Android users

This is one of the leading apps in the finance category. With it’s ability to compile all of your financial information into one place, it tracks your account balances, spending by category, and keeps track of the budget you set, alerting you when you are reaching your limit for each category. It’s user friendly and a fantastic way to stay on top of your finances while on the go!

2. Everydollar

Visit the site here | Download available for Apple users

This app is created by one of the most well-known financial advisors, the brilliant Dave Ramsey. It is based on his proven plan for eliminating debt and building wealth. Like Mint, it keeps track of your spending and income, but all while being based on Dave Ramsey’s proven plan for eliminating debt and building wealth! It also has new updates coming to help with investing, tax preparation, and insurance. Based on the reviews, many people prefer it to Mint. This can be accessed on computers and iPhones, but Android users will have to use their computers while they wait for a version to be created.

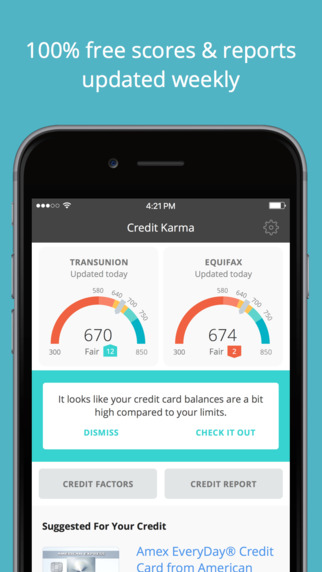

3. Credit Karma

Visit the site here | Download available for Apple users & Android users

It’s important to be able to stay on top of your credit score, but unfortunately most websites that advertise showing you your credit score for “free” actually make you pay in the end. Credit Karma, however, is entirely free. You never have to enter a credit card number, and with the app, you can view your credit score as many times a day as you would like! It updates your score every week and includes information as to why your score has changed, such as late payments or credit card utilization. This can also be used on both your computer and mobile devices.

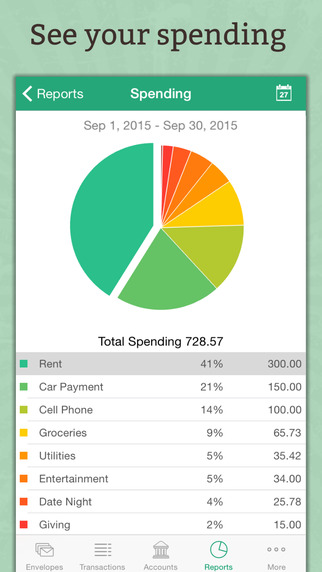

4. Goodbudget

Visit the site here | Download available for Apple users & Android users

Like a few other finance apps, this one is for budgeting, however it is based on the envelope budgeting method, which is one of my personal favorite methods for controlling my spending and knowing where each dime is going. This app lets you to make “envelopes” for all of the categories in your budget and set aside your money up front in each envelope, allowing you to spend based on categories and not just your account balance. As they describe it on their website, “It’s a great way to plan spending and not just track spending.” You can also sync and share household budgets across devices so that you and your family are all on the same page.

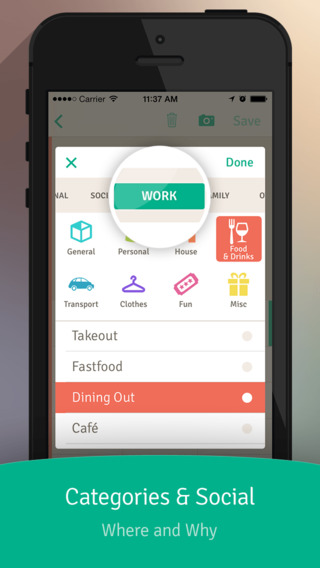

5. Wally

Visit the site here | Download available for Apple users & Android users

The best thing about this app is that it allows you to scan your receipts so you don’t have to manually input the details of your purchase. This has to be the best feature as it saves time. Like the previous apps it helps track your expenses and you can view how much you have spent while dividing your expenses into categories.

Do you have any other personal finance apps you’d suggest?

Great article! But I would like to add one more app to your list. I use Wallet (https://play.google.com/store/apps/details?id=com.droid4you.application.wallet) to manage my finances. It takes a lot of time off my schedule that I used to spend stressing over my money. You can either sync your bank account or import your transactions to the app, or just track it to know where you spend your money. You can also set goals, budget, track your debt and so much more. Wallet has worked wonders for my finances and I think it’ll help all other working women like me to take stress about their money out of their lives.